In mid-August, Imperial Tobacco again raised prices on its tobacco products. As shown in the price list circulated to retailers and pasted below, they are now charging from $2.50 to $4.50 more per carton in Ontario. Price increases in other provinces have not yet been located, but they are usually imposed at the same time.

This is the second major industry price increase this year -- in January prices went up pby $2.50 to $3.60 per carton for Imperial Tobacco brands. The other two major companies (Rothmans, Benson & Hedges and JTI-Macdonald) traditionally follow with identical increases within a week of Imperial's announcement.

Variable price increases lift profits without reducing sales

The company is continuing a now-familiar pricing strategy:

- discourage governments from increasing taxes (by threatening contraband)

- while taxes are constant, increase corporate profits with a general price increase

- apply different price increases to different brands and in different provinces, so that price-sensitive smokers are less likely to be affected.

- maintain discount pricing for certain retailers to ensure that a cheaper source of cigarettes is maintained.

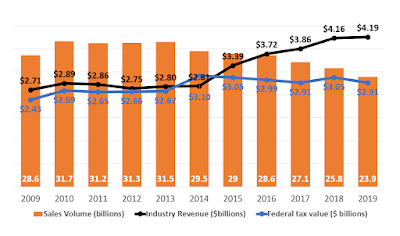

Historic trends show industry revenues are climbing on decreasing sales

Cigarette sales (and smoking) continue on slow downward slope in Canada as they do elsewhere.

But although the volume of cigarettes sold in Canada declined by 18% over the past 5 years. (from 29 billion to 23.4 billion) and the number of smokers decreased by 12% (from 5.3 million to 4.7 million), tobacco industry revenue increased by 24%. Health Canada has not yet released sales or revenue data for 2020.

|

| Billions of cigarettes sold, federal taxes collected and industry revenues 2009-2019. |

Industry prices go up, but taxes stay stable.

While tobacco companies raise prices every 6 months the Ontario government has not adjusted its tobacco taxes in two and a half years. This year, only a few governments have done so. Both British Columbia and Nova Scotia raised tobacco taxes by $4 per carton, and PEI raised its taxes by $5.00. Manitoba announced a $1 per carton increase in its spring budget, but later deferred imposing it. The federal government imposed an inflation-related increase of $0.46 per carton in April.

Some countries do not permit unauthorized tobacco price increases.

Price regulation in other nations requires tobacco companies to seek authority from tax officials before raising their prices. Tobacco Journal International reported this week that Japan Tobacco had received permission this summer. Permission is also required in France for price adjustments to tobacco products.

Updated fact sheets

- Canadian taxes on manufactured cigarettes

- Canadian taxes on finecut tobacco

- Canadian taxes on smokeless tobacco

- Canadian taxes on heated tobacco

|

| Imperial Tobacco Ontario Price Increase August 2020 |