Over the past few weeks there has been a flurry of reports from tobacco companies about their business activities over the past year and their plans for the coming months.

- On February 17, BAT issued its preliminary results for 2020 and the next day presented at the CAGNY investor meeting (Consumer Analyst Group of New York)

- On February 10, Philip Morris International hosted an Investor Day, a week after it had issued its preliminary results for 2020

- On February 9, Japan Tobacco International reported on its preliminary results and its business plan for the coming year

- On February 18, Imperial Brands (which does not have significant operations in Canada) also presented at the CAGNY conference, after hosting an investor session earlier in January.

- U.S.-based Altria also presented at CAGNY this week, and issued its preliminary results last month.

These communications do more than meet the obligations of companies to provide business information to shareholders. Because they are designed to raise the confidence of investors and the business community in the companies, they contain lots of information about how this sector is reorganizing its business focus, refurbishing its image and remaining committed to extending nicotine use.

There is much in these presentations to interest the public health community - this post provides only a sampling.

_________________________

COVID-19 AND THE GLOBAL TOBACCO MARKET

Cigarette sales were stable in the United States:

Altria reported that sales in the USA did not fall in 2020, for the first time in 5 years. Altria is the only company to state the total market volume of combustible and other tobacco products in a comparable way. Its depiction of the market in the USA over the past 6 years (slide 4) shows a slight decline (1% per year) in the volume of all nicotine products, from the equivalent of 16.8 to 15.9 billion packages. From the information provided, we can calculate that after 5 years, tobacco sales had fallen by 1.7 billion packages, about half of which (the equivalent of 800 billion packages) was offset by increased sales in oral and e-vapour products.

The reduction in U.S. cigarette sales may be slowing down. Combining this year's Altria reports with those from previous years shows that cigarette sales are not decreasing at a faster rate in the past 5 years when compared with the previous decade. Between 2007 and 2011, sales fell by an average of 5% per year. By 2020, they fell by only an average of 3% per year.

|

| Compilation of data from Altria's earnings reports |

Cigarette sales went down in most other countries.

Despite this North American experience of increased or stable sales, Philip Morris International reported this month that on a global basis sales were down by 7% in 2020 over the previous year, more than twice the usual rate of decline. (Slide 66)

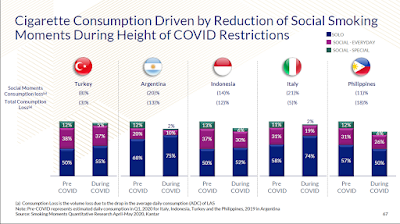

Chief Operating Officer Jacek Olczak explained that one of the reasons for the drop was that restrictions on movement and socializing resulted in fewer occasions when smoking was embedded in social rituals "physical journeys, the bust of the smoking break, the lunch break with colleagues, the evening and beer in the bar, et cetera, all of these things have almost disappeared during COVID time." He reassured investors that "social consumption will be a big part of the rebound coming forward."

He illustrated this decline by sharing consumer research on "smoking moments" conducted in 5 different markets, before and during COVID restrictions. (Slide 67)

|

_________________________________

CIGARETTES REMAIN KING

Cigarettes remain the bread-and-butter of tobacco companies. PMI reports that ninety-four cents of every dollar spent in the globalized tobacco market (which excludes China and the USA) is exchanged for a cigarette. (Slide 11)REGIONALIZATION OF ALTERNATE NICOTINE PRODUCTS

Cigarettes are the dominant form of tobacco use through much of the world, with some notable exceptions such as India. Over the past decade, these companies have introduced products which they are proposing as alternatives to cigarettes. These recent investor presentations show how regionalized the succesas of these products has besen.

* Almost all (90%) of modern oral (snus and tobacco-free pouches) is sold in only 6 markets: the USA, Germany, Sweden, Norway, Denmark and Switzerland.

* Similarly, 90% of revenue from heated tobacco (like IQOS and glo) comes from only 9 countries - Japan, South Korea, Russia, Italy, Romania, Germany, Ukraine, Poland and the Czech Republic. (Page 58 and Slide 16)

* Only 5 countries account for 75% of the value of vaping product sales. Canada was second on the ordered list - behind the USA, but ahead of the United Kingdom, France and Germany. Given that Canada is one-tenth the size of the USA and half that of the UK, France and Germany, this suggests that per capita expenditure on this category of vaping products is higher in Canada than in any other country. (Page 58) BAT also reported that during 2020 its VUSE devices and liquids out-sold other products on the market. For every $1 spent in Canada on closed vaping systems, 46 cents was spent on a VUSE product. (Page 11)

FUTURE PLANS - ALTERNATE NICOTINE AND BEYOND

|

__________________________

TALKING UP THEIR NEW CORPORATE IMAGE

These presentations also give insight into the public relations focus of PMI and BAT, and their attempts to present themselves as the solution to the tobacco problem, not the cause.

ESG (Environmental, Social and Governance) issues are front and centre, no longer relegated to supplementary reports as they were in the past. Altria's CAGNY presentation this week illustrates how they area contextualizing their new business lines and regulatory priorities in the ESG framework. (slide 5).

Their recently-trademarked slogans reflect their transformation goals: PMI is "delivering a Smoke-Free Future", BAT has "A Better Tomorrow", Altria is "Moving beyond smoking."

|

________________________________