In a series of presentations to investors today, British American Tobacco laid out its "new purpose" and unveiled its new look. Last year it was "transforming tobacco" and "accelerating delivery". This year the catch phrase --- trademarked of course -- is "a better tomorrow.

In a series of presentations to investors today, British American Tobacco laid out its "new purpose" and unveiled its new look. Last year it was "transforming tobacco" and "accelerating delivery". This year the catch phrase --- trademarked of course -- is "a better tomorrow.The new corporate purpose laid out by BAT's management was "to reduce the health impact of our business through offering a greater choice of enjoyable and less risky products for our consumers." Their target is to develop a customer base of 50 million people for these products over the next decade.

BAT reported today that they estimate that there are currently 68 million consumers using non-combustible products, of whom 11 million (16%) use BAT products. By their estimates, non-combustible consumers are less than 6% of the total nicotine market. (They do not include China or India in their estimates).

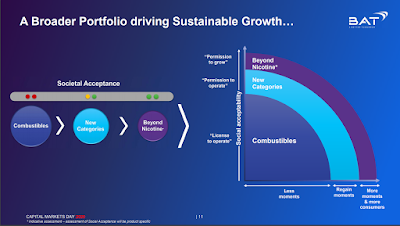

Recapturing consumer moments

A key goal for BAT is to regain the ground they have lost - "to recapture consumer moments" - through the sale of electronic cigarettes, heat not burn and oral nicotine. As they present it, these products can be used by smokers who are no longer able to use tobacco at work, in transit or with other people. Vaping products are helping them regain such moments - and they expect that future product offerings will help them get "more moments and more consumers".

Not fewer smokers, but more vapers

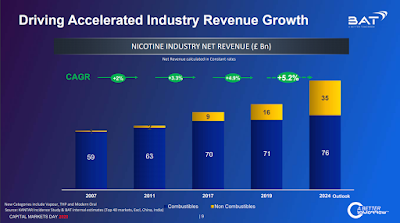

To further emphasize that their strategy is based on recruiting consumers for non-combustible cigarettes and not based on reducing smokers, BAT provides forecasts of its revenues for both categories. There was no emphasis in these reports on converting existing smokers, but there was on "stimulating the senses of new adult consumers" (emphasis added).

To finding new products for new consumers, BAT plans to leverage big data (it has a data base of 7 million consumers), to expand e-commerce and social media. Product design and innovation are emphasized. People don't like the new hybrid heat-not-burn and vapour product (Glo Sens) so they are rolling out a new concept (Glo Hyper), which allows uysers to customize their taste experience of heat-not-burn products.

Important details are shared:

BAT reveals that younger people like ePOD, while older people prefer ePen, that they use artificial intelligence to develop food pairing, that upscaling (premiumisation) is a way to add imagery to products and that their chain of 750 "inspiration stores" are exceeding expectations.

They give numbers to the changing vaping marketplace. Open systems and vape shops are out, and closed systems and convenience stores or e-commerce are in.

BAT signals that it is consolidating its vape portfolio: abandoning 10 of its vape products to concentrate on 2 (ePod and ePen 3), shifting to the Vuse brand name, reducing flavours from over 1000 (!) to a mere 170. These changes are driven by digital technologies - big data, artificial intelligence, direct marketing, "leveraging social media listening", etc.

And for Canada?

Only modest information is given about the Canadian market. Citing point of sale scanner data, BAT says that JUUL and Vype have roughly equal schare of devices, and that about two-thirds of the pods sold are JUUL, compared to slightly over one quarter which are Vype.

Cigarette sales are down in many countries

The presentations also offered a lot of data on trends in cigarette sales. Details on those trends, and comparisons with Canadian sales data, will be shared later this week.

Links to BAT presentations*

*you will need to identify yourself as a shareholder to access)