It's that time of year again. The days are growing shorter, and parents are scurrying to find school outfits for children who have suddenly grown taller. Soon, teachers will be assigning their charges with the ritual essay "how I spent my summer vacation", and using the results to build their lesson plans for the coming year.

This post reviews actions of the tobacco industry over the summer months -- and points the way to issues that health regulators may want to turn their attention to.

Yet more nicotine products on the horizonA new entry in the "what nicotine product will they think of next" category is being promoted to investors this week. Vancouver-based Poda Lifestyles has developed a heat-not-burn nicotine device that replaces tobacco with synthetic nicotine and tea leaf pellets. They tell investors that this product is "outside the scope of existing tobacco regulations and duties". The team which is guiding this initiative includes alumni from Philip Morris and JUUL.

It would appear that Heat-not-burn nicotine-tea devices may fall outside Canada's federal tobacco laws? Because they are not made of tobacco and if don't produce an aerosol, they are likely not captured by the current definitions in the Tobacco and Vaping Products Act.

2) TJP and Canadian-made nicotine pouches

An Ontario factory is planning to manufacture 36 million nicotine pouches per month starting early next year. TJP announced last month that it had recruited investments to permit production out of Pickering, a short distance from Toronto. This privately-held company began as the maker of "The Juice Punk" e-liquids.

Nicotine pouches are not currently legal for sale in Canada, as they fall under the Food and Drugs Act and thus require authorization. Last year Health Canada issued an advisory that they were "unauthorized" and demanded that some be pulled from the market.

In recent years they have become energetically marketed in other countries as a harm-reduction product.

Big Tobacco drifts towards Big Pharma

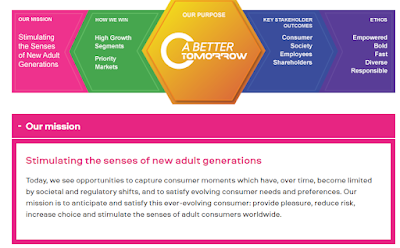

Philip Morris International is the owner of Rothmans, Benson and Hedges, a company which sells about 4 in 10 of the cigarettes legally sold in Canada. Both the international company and its Canadian operation have ramped up their efforts to "transform" their operations to sell an enhanced range of nicotine and non-nicotine products, redeem their reputations and regain influence over public policy.

This summer PMI made headlines as it attempts to acquire Vectura, a manufacturer of inhaled delivery systems for asthma and chronic lung disease medications manufactured by other pharmaceutical firms. Its ownership by a tobacco company has raised concern and alarm among U.KI. health charities.

PMI has recently acquired other pharmaceutical companies, including OtiTopic (which makes medications for heart disease) and Fertin (which makes gums and other oral delivery systems, including NRT and cannabis).

PMI now has a foothold in 2 Canadian pharmaceutical operations. It will soon own 100% of Fertin's Canadian operation, Nordiccan (which currently markets cannabinoid pouches in Canada) and 40% ownership of Medicago (which controversially received federal funding to work on a COVID vaccine).

Philip Morris International tries steer Endgame thinking

In July, the new CEO of Philip Morris International (Jacek Olczak) made headlines by calling on the U.K. government to ban cigarettes within the next 10 years. The United Kingdom is currently developing a new (post-Brexit) tobacco plan. In 2019, the government called on the industry "to make smoked tobacco obsolete", but few established tobacco control leaders in that country are calling for legal controls to make that happen.

Rothmans, Benson and Hedges gets citizen volunteers to clean up its commercial waste

Cigarette filters are a single-use plastic that is one of the most frequent forms of litter and a source of pollutants, which is why there is increasing pressure for regulations that impose producer responsibility on the industry. In an apparent effort to head regulations off at the pass, Philip Morris' Canadian operation is trying to gain a leading position in the Canadian response to cigarette waste.

This summer it ramped up these efforts on two fronts.

1. Through a partnership with Terracycle, Rothmans, Benson and Hedges is funding community groups to sign up to collect cigarette butts (either through sweep-up operations or public ashtrays) and remit them in return for gifts or cash. Each pound of waste is worth $1. This summer a "sweepstake" contest offered incentives to newly recruited locations and individuals.

2. This summer, RBH offered grants of up to $5,000 to non-profit organizations to support litter cleanup projects (the activities were not restricted to tobacco waste). Eligible expenses were restricted to organizing, hosting and promoting -- groups would receive money for the equipment required to conduct the cleanup, but were expected to provide volunteer labour. This summer $75,000 in grants were provided: the predominant recipients seem to be ATV clubs.