Bragging rights are a short quiz away!....(and yes, there are some trick questions).

-----------------------

What slogan did it adopt?

a) We've come a long way, baby

b) Accelerating Delivery

c) A better tomorrow

d) I'd rather switch than fight

e) A taste you can call your own

2) The federal government recently made public its tax revenues from tobacco sales in 2018-2019 and its budget for tobacco control for 2020-2021.

Which of the following statements are true?

a) For every $1 in federal tobacco tax revenue, 1 cent will be spent on tobacco control.

b) For every Canadian smoker, the federal government will spend less than $10 per year on tobacco control.

c) The average Canadian smokers pays about $700 per year in federal tobacco taxes.

d) Federal Government revenues from tobacco sales are increasing faster than industry revenues.

3) In January the Council of Chief Medical Officers of Health recommended that governments adopt several measures to prevent youth vaping.

Which of the following did they not recommend?

a) ban all flavoured vaping products and then provide regulatory exemptiosn for a minimum sets of flavours.

b) limit nicotine levels in vaping products to a maximum of 20 mg/ml.

c) tax vaping products in a manner consistent with maximizing youth protection while providing some degree of preferential pricing.

d) promote e-cigarettes as a form of harm reduction.

e) increase the minimum age for tobacco and vaping to 21 years.

4) In December the results of the Canadian Student Tobacco Alcohol and Drug Survey were released. In only one province the rate of youth vaping had not doubled over the past 4 years.

Which province was that?

5) Plain packaging of tobacco products came fully into effect in Canada in February 2020.

Which of the following countries has not yet implemented plain packaging? (A bonus point to identify those countries which require plain packaging of e-cigarettes).

a) Turkey

b) Uruguay

c) Saudi Arabia

d) Israel

e) Singapore

6) At least 40 countries do not permit the sale of electronic cigarettes as consumer products.

Which of the following statements is not true?

a) These countries represent about one-third of the world's population.

b) Among these countries are several with advanced tobacco control strategies, including one-third of the countries which have passed plain-packaging regulations for tobacco.

c) These countries are found in each of the World Health Organization's 6 regions.

d) These countries include member states of the European Union.

7) Which of the following trademarks were not recently registered by a tobacco company in Canada?

a) World of White

b) Cool Flow

c) Press and Roll

d) Voke

e) True me

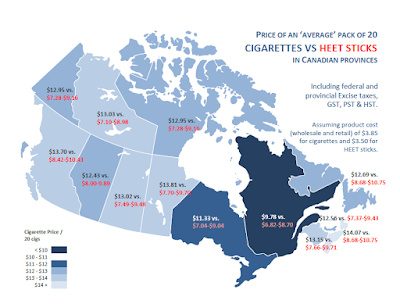

8) How many Canadian provinces have implemented a tax on vaping products?

9) The Lung Association and Heart and Stroke are sponsoring PSA to encourage governments to protect kids from vaping.

What products do they use to make their point? (no peeking!)

a) Pokemon

b) Lego

c) Ice-cream

d) My little pony

e) Fidget spinners

10) Which of the following are cities in Canada not authorized to regulate?

a) minimum prices on cigarettes

b) flavourings in vaping products

c) minimum separation distances between tobacco retailers

d) moratorium on new licenses to sell tobacco or vaping products

e) a regulatory fee to pay for cleaning up filters and e-cigarette waste

11) Which of the following countries do not allow retailers to set their own prices for tobacco products?

a) China

b) Brazil

c) France

e) Japan

e) Sweden

12) The number of tobacco retailers has fallen in Canada by how much since 2000?

a) 10%

b) 15%

c) 20%

d) 25%

e) 30%

13) Which of the following statements are not true?

a) For every post office outlet, Canadians have access to 4 tobacco retailers.

b) Canada has more tobacco retailers per capita than the United States.

c) Canada has more tobacco retailers per capita than France.

d) Canada has more than twice as many tobacco retailers as it has gas stations.

14). British American Tobacco announced that around the world it was changing the brand name of its e-cigarettes from VYPE to VUSE (the name which previously was used only in the United States).

Why did they do this?

15) Canadian provinces are currently in the 7th month of mediation talks with tobacco companies to settle the lawsuits filed by provinces over the past 2 decades.

Which of the following is not true?

a) the provinces have claimed in excess of $600 billion in health care costs related to the companies' wrongful actions.

b) neither the Canadian companies nor their foreign owners has put money aside to cover the payments they may be required to make as a result of lawsuits.

c) the lawyers representing most of the provinces are working on a contingency basis, with agreements that will pay them up to 30% of any settlement amounts.

d) the provinces have sought advice from the health and medical communities on how to use the lawsuits to reduce smoking.

BONUS Question

16) Why did we circulate this quiz?

Answers

- c) A better tomorrow. Accelerating Delivery was a slogan used by BAT in recent years, the others are advertising slogans for cigarettes.

- All but d) are true.

- d) The council made no reference to harm reduction.

- There was no increase noticed in New Brunswick because the survey was not previously conducted in that province.

- e) Singapore's regulations do not come into effect until July 2020, when it will be the 14th country to have put this in place. Israel has required plain packaging of e-cigarettes since January 2020.

- d) EU members are required to permit the sale of e-cigarettes.

- d) VOKE. That trademark was abandoned by tobacco company BAT, and has been picked up by Kind Consumer.

- a) Only British Columbia has implemented a tax on vaping products. Nova Scotia will implement its tax in September 2020. Alberta has said it will impose a tax, but has not yet set a date.

- c) Ice-cream. The campaign is called "Get the scoop".

- Cities have the power to impose all these regulations.

- Japan, Brazil and France restrict retail competition for cigarettes by establishing the price which retailers must charge for each brand.

- e) In 2000, there were approximately 40,000 tobacco retailers in Canada, compared with 28,000 in 2018 - a 30% reduction

- B is not true. In the USA there are about 115 tobacco retailers for 100,000 people, compared with 71 in Canada.

- We don't know either. Give yourself a point.

- d) Despite requests for meetings, none of the provinces has agreed to or initiated public consultations on resolving these lawsuits.

- To encourage you to take note of our recently-released information products, linked below.

However you scored, give yourself perfect marks for caring enough to try.

------------------------

Information on these and other current topics in tobacco can be found in our newly-released documents: