Earlier this week, the federal government tabled in parliament its annual report on public accounts. Together with similar reports from provincial governments (or budget statements where the public accounts are not yet ready), we now have a picture of the amount of taxes collected by Canadian governments on tobacco products over the past fiscal year - April 1, 2019 to March 31, 2020.

In all but one province (Manitoba), tobacco tax revenues were down. Last year a total of $7.64 billion were collected by territorial, provincial and federal governments in excise taxes imposed on cigarettes, cigars, smokeless, rawleaf, manufactured and other forms of tobacco. The previous year, the amount collected had totalled $8.29 billion. Links to tables of historic tax revenues and other data are provided below.

Federal and provincial tobacco tax revenues are declining slowly, once adjusted for inflation.

Despite periodic increases in some provinces, tobacco tax revenues have been essentially flat (with a recent downward trend) for more than a decade, once inflation is taken into consideration.

Several factors contribute to the amount of tobacco tax received by governments: the tax rate, the number of smokers and the volume of cigarettes smoked on which taxes have been avoided (illicit sales). Other than cigars (which account for less than 2% of federal tobacco tax revenue), tobacco products are taxed on a per-unit or per-weight basis and changes to retail prices have no impact on government revenues.

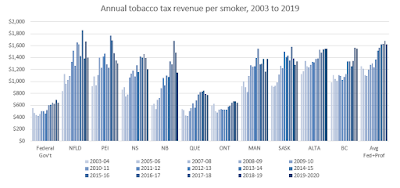

The average smoker provides more than twice as much tax revenue in some provinces than others.

Tobacco tax rates and the sale of untaxed tobacco vary significantly across Canadian provinces, and so too does the amount of tax received per average cigarette smoker. Ontario, which has the second-lowest cigarette tax rate and is believed to have the highest contraband rate, received the least revenue on a per-smoker basis ($650). Quebec, with the lowest tax-rate recieved slightly more ($775). Per-smoker revenue for the other provinces ranged from $1,200 to $1,625. In addition, federal tax revenues on tobacco products were about $650 per smoker.

The impression that revenues per smoker have grown over the past 15 years is corrected once the revenues are adjusted for inflation. Both adjusted and unadjusted amounts are shown in the figures below.

(These figures are approximations only, as the Canadian Community Health Survey only provides estimates of the number of cigarette smokers and most public accounts only provide total combined revenues for all types of tobacco products. About 95% of the value of the wholesale tobacco market is for manufactured cigarettes.)

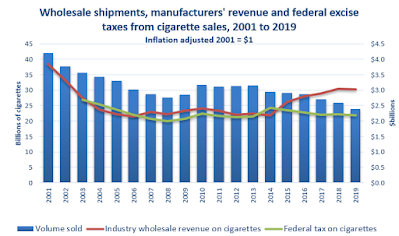

Tobacco industry revenues are increasing while tax revenues aren't.

Not all tobacco-related revenues are stagnant. Data released earlier this year by Health Canada (based on calendar, not fiscal years) show that although federal tax revenues have been stagnant, the revenue received through wholesale shipments has continued to climb.

From the information reported to and by Health Canada, between 2009 and 2019 the volume of cigarette sales has fallen by 17% (from 28.6 to 23.9 billion), wholesale revenues on cigarette sales have climbed by 55% (from $2.7 billion to $4.2 billion) and cigarette taxes remitted to the federal government have increased by 25% (from $2.4 billion to $3 billion).

Related data sheets: