This week’s news that British American Tobacco (BAT) acquired a large share of Organigram, a Canadian cannabis company should have come as no surprise. Tobacco companies have recently signalled that they are very much getting into the cannabis business.

In yesterday's press release revealing of the deal, BAT reminded the business community of its plans to expand into new drug markets. As it has previously explained, vaping is key to restoring the size of its traditional customer base - but products like cannabis are the key to enlarging it.

"This agreement augments ongoing BAT activities to expand its portfolio ‘beyond nicotine’ and follows the pilot launch of Vuse CBD Zone in Manchester, UK earlier this year. The collaboration reinforces BAT’s consumer-centric multi-category approach."

‘Beyond nicotine’ is key to gaining even more customers.

BAT says the Organigram deal “augments ongoing BAT activities to expand its portfolio ‘beyond nicotine’ and follows the pilot launch of Vuse CBD Zone in Manchester, UK earlier this year. The collaboration reinforces BAT’s consumer-centric multi-category approach.”

The agreement between BAT and Organigram involves a trade of £126 million (Cdn $240 million) in return for one-fifth (19.9%) of Organigram’s shares, and a couple of seats at the board table. The companies will co-manage a ‘Centre of Excellence’ based in New Brunswick and work together to develop the “next generation of cannabis products”.

The resource imbalance between selling and protecting

This agreement exposes the imbalance between the deep pockets available to BAT and other tobacco companies to increase their market, and the small amount that is made available to governments to protect consumers from this marketing.

Relative to its overall operating costs, BAT’s investment in Organigram is small, but it nontheless dwarfs public investments in Canada to reduce the harms from tobacco or cannabis. Last year Health Canada spent ($35 million on tobacco control activities) and ($66 million on cannabis-related activities.)

The writing on the wall: a merged tobacco-cannabis market

The plans of BAT and Philip Morris International to become players in other drug market is captured on recent slide presentations made to investors. While BAT makes explicit that their focus is on cannabis, PMI speaks euphemistically about “botanicals”.

In February, BAT told investment analysts in New York that its new business lines would allow them to apply their distribution channels, their political influence, their 'M&A' ability to gobble up competitors and their 'insights' into human drug use.

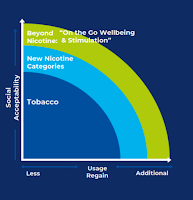

The drug effects they were targetting (BAT slide 36 shown below) are "on the go wellbeing and stimulation", "boost & energy", "clarity and focus", "calm and relax". With "high growth & margin categories" they predict there is lots of money to be made.

In the same week, PMI hosted an overview of its operations for investors, during which the CEO presented their rationale for getting into the business of selling other drugs ("going beyond nicotine").

Like BAT, PMI sees its experience in tobacco, its knowledge of inhaled drugs, its product distribution strengths and its marketing savvy - "ability to change consumer behaviour" - are assets that can be applied to such "new adjacent areas". The company predicts that within four years that the market for these non-tobacco drug 'botanicals' will hit US $29 billion (Cdn $36 billion). (PMI slide 34)

The regulatory response that is yet to be drafted

Canada was a pioneer in the commercialization of cannabis, and consequently may be forced into being a pioneer of ways to address the economic and technical power of tobacco companies to forge a commercial synergy that increases the harms of tobacco and cannabis.

Canadian laws already provide some protection from tobacco companies fuelling a new wave of drug use. Provincial cannabis laws ensure that cannabis and tobacco cannot be sold in the same store. Federal cannabis and tobacco laws draws lines between tobacco, vaping and cannabis products - cross-branding of tobacco and vaping products is forbidden and vaping products can't taste like cannabis - but these laws were not drafted in anticipation of the new realitiy. There are no investment restrictions, no barriers to sharing of consumer research, co-marketing, or other accelerators of nicotine, cannabis and other drug sales.

The vulnerable consumer vs market growth

Cannabis and tobacco suppliers compete largely in the same market. Canadian researchers found that in 2013-2014 half of Canadians who have smoked cannabis more than once in the past year are also tobacco smokers and more than three million Canada's 5.5 million smokers were also ever users of cannabis. [1] (The higher risk of smoking among cannabis users is considerably larger than for other risk factors, including education, income, race, gender, indigenous status, etc).

Canadian smokers and tokers often use both products together. University of Tornto researchers analyzed data from a health monitoring survey conducted in Ontario from 1996 to 2017. In 2017, 40% of Ontarians who used cannabis had mixed tobacco with it (although this percentage had declined over years). [2]

More evidence of the harms of cannabisRecently-published research provides new reasons for regulators to respond forcefully to any development that increases the likelihood of smoking tobacco or cannabis.

Historically, because cannabis use is so frequently associated with tobacco use, it has been hard to know what the risks of cannabis use are, as distinct from the risks of tobacco use. This has changed. American researchers, led by Siddarth Shah [3] succeeded is isolating the health consequences of cannabis use from those of tobacco by using data from the U.S. Behavioral Risk Factor Surveillance System. This is a nationally representative survey with a very large sample size, and by pooling data from three years they were able to have observations for 133,706 cannabis users who had never smoked tobacco cigarettes. They found that frequent cannabis smoking (10 or more days a month) was associated with an 88% increase in the risk of coronary artery disease and an 81% increase in the risk of stroke.

Historically, because cannabis use is so frequently associated with tobacco use, it has been hard to know what the risks of cannabis use are, as distinct from the risks of tobacco use. This has changed. American researchers, led by Siddarth Shah [3] succeeded is isolating the health consequences of cannabis use from those of tobacco by using data from the U.S. Behavioral Risk Factor Surveillance System. This is a nationally representative survey with a very large sample size, and by pooling data from three years they were able to have observations for 133,706 cannabis users who had never smoked tobacco cigarettes. They found that frequent cannabis smoking (10 or more days a month) was associated with an 88% increase in the risk of coronary artery disease and an 81% increase in the risk of stroke.[2] Navitha Jayakumar, MPH, Michael Chaiton, PhD, Renee Goodwin, PhD, MPH, Robert Schwartz, PhD, Shawn O’Connor, PhD, Pamela Kaufman, MLA, PhD. Co-use and mixing tobacco with cannabis among Ontario adults. Nicotine & Tobacco Research, Volume 23, Issue 1, January 2021.