Three hundred and fifty-four days ago, a budget was presented to the Canadian parliament that proposed tax on vaping products to be applied in 2022, [1] and invited "input from industry and stakeholders on these proposals to help ensure the effective imposition and collection of excise duties on vaping products."

Yesterday the details on this tax were made clear in the 2022 federal budget [2] The budget was accompanied by a ways and means motion with the necessary changes to the Excise Act, effective October 1, 2022. [3]

This post looks at the evolution of this tax proposal and at the impact it will have on some vaping liquid prices.

Finance Canada has adjusted the tax to increase the rate for larger containers.

In 2021 the federal proposal read as follows: "The proposed framework would impose a single flat rate duty on every 10 millilitres (ml) of vaping liquid or fraction thereof, within an immediate container (i.e., the container holding the liquid itself). This rate could be in the order of $1.00 per 10 ml or fraction thereof, and the excise duty would be calculated and imposed based on the volume of the smallest immediate container holding the liquid."

In 2022, the proposed tax read as follows: "Budget 2022 proposes to implement the previously announced excise duty on vaping products, effective as of October 1, 2022. The proposed federal excise duty rate would be $1.00 per 2 ml, or fraction thereof, for containers with less than 10 ml of vaping liquid. For containers with more than 10 ml, the applicable federal rate would be $5.00 for the first 10 mL, and $1.00 for every additional 10 ml, or fraction thereof."

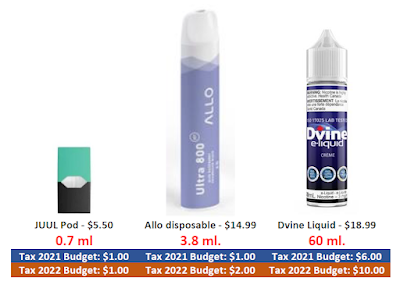

The difference can be illustrated examining three product categories:

- e-liquid pods for devices like JUUL, VUSE or STLTH,

- disposable devices like Allo,

- e-liquid bottles designed to be used in refillable containers or tanks.

For all products, the tax is applied on the basis of the volume of liquid: the cost of the unit, the strength or type of nicotine is not a factor. Pods (which are often sold in packages of 2 or 4 units) will bear a tax of $1 per pod (unchanged since 2021). Mid-volume disposables will bear a tax of $1 per 2 ml (higher than last year). Containers with more than 10 ml will be taxed at a considerably higher rate than proposed last year (because of a minimum $5 per 10 ml).

The federal government is continuing to extend an offer to provinces to participate in a joint vaping tax program in which the tax revenues would be split. Importantly, this is identifying as something to be managed to achieve public health goals ("The overall tax burden on vaping products will be regularly reviewed to ensure that important public health objectives are being met."). This cooperative approach is currently in place for cannabis, as seen in the Quebec-Canadian agreement here, but has not been negotiated for tobacco.

The new tax will recover an estimated $10 to $50 per month from Canadian vapers.

There is wide variability among devices and users, which makes it difficult to compare the price of a “unit dose” of nicotine from vaping with those from tobacco. Nonetheless, studies of vapers have found typical consumption of 22 ml to 63 ml per week (3 ml to 10 ml per day),[4] with daily JUUL users consuming 10 pods per month.[5] A JUUL pod has been found to deliver to the human body the equivalent amount of nicotine as a package of cigarettes.[6] Health Canada’s surveys report that spending on devices and liquids averages $53 for devices-components each month and $52 for liquids,[7] giving an average daily cost of about $3.25.

On the basis of those reports, the proposed tax will trigger a monthly increase in cost of:

- $10 for the typical JUUL user [5]; $30 for someone who consumers 1 pod per day

- $13 (for 3 ml/day user) to $50 (for 10 ml/day user purchasing 60 ml bottles) [4]

Minimum wages ranging from $11.81 to $16 across Canada. Using the estimates of post-tax prices for vaping pods and vaping liquids, it will take a minimum wage earner between half an hour and an hour to earn enough to purchase a taxed e-liquid pod, and between 3 and 6 minutes to purchase a ml of e-liquid.

References

[1] Government of Canada. Federal Budget. April 2021.

[2] Government of Canada. Federal Budget. April 2022.

[3] Notice of Ways and Means Motion to amend the Excise Act, 2001 and Other Related Texts

[9] Physicians for a Smoke-Free Canada Taxes on cigarettes in Canadian jurisdictions. April 2022